What Is an Index Fund? Understanding the Basics

What Is an Index Fund? A Beginner’s Guide to Navigating the Stock Market

If you’re new to the world of investing, you’ve probably come across the term “index fund” more than once. But what exactly is an index fund, and why should it matter to you? In this article, we’ll dive into the depths of index funds, demystify the jargon, and shed light on why they can be a smart choice for both seasoned investors and beginners alike.Understanding the Basics

Let’s start with the basics. An index fund is a type of investment fund that aims to replicate the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. It’s like buying a basket of stocks that mirror the composition of the chosen index, providing you with broad exposure to the overall market or a specific sector.The Beauty of Simplicity

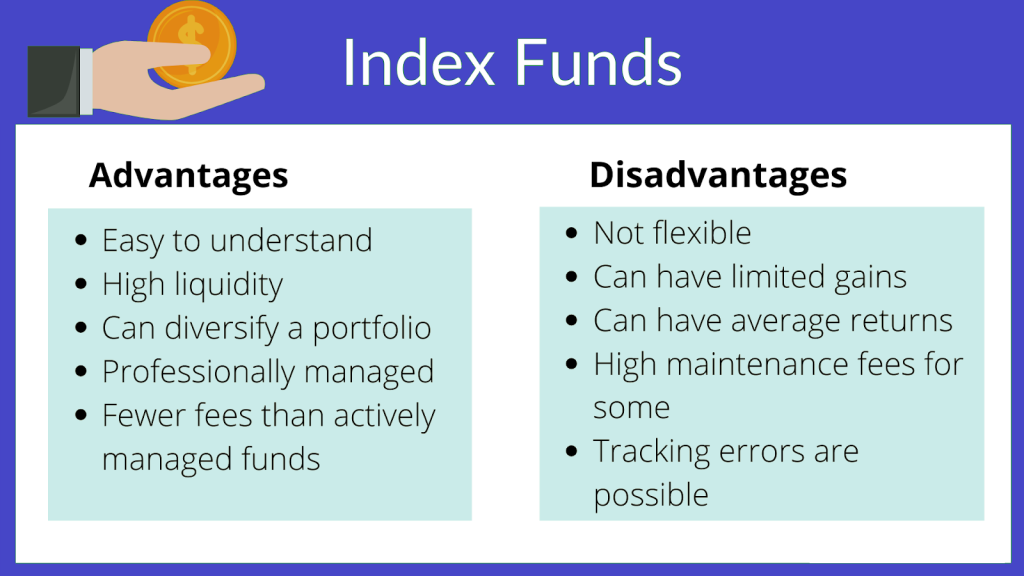

One of the key advantages of index funds lies in their simplicity. They follow a passive investment strategy, meaning they don’t rely on the skill or expertise of a fund manager to handpick individual stocks. Instead, they aim to match the performance of the underlying index by holding the same stocks in the same proportion as the index itself. This “set it and forget it” approach offers several benefits. First, it eliminates the need for you to constantly monitor and analyze individual stocks. Second, it helps reduce the costs typically associated with actively managed funds, as index funds have lower expense ratios. And finally, it mitigates the risk of underperforming the market, as active fund managers often struggle to consistently beat their benchmarks.